The DB WM Strategic Asset Allocation (SAA) Funds help you focus on the long term and build your core portfolio by harnessing the expertise and robustness of our index-based asset allocation model.

A well-diversified portfolio is critical to performance. Yet, this can be costly and complex to achieve and maintain.

Our five SAA Funds offer a simple and cost-effective way to leverage our Chief Investment Office (CIO) expertise and the platform of DWS.1

Our Plus2 versions use systematic hedging to minimise downside risk while maximising exposure to growth assets.

Emphasises wealth preservation over time

Balanced portfolio approach

Favours capital growth

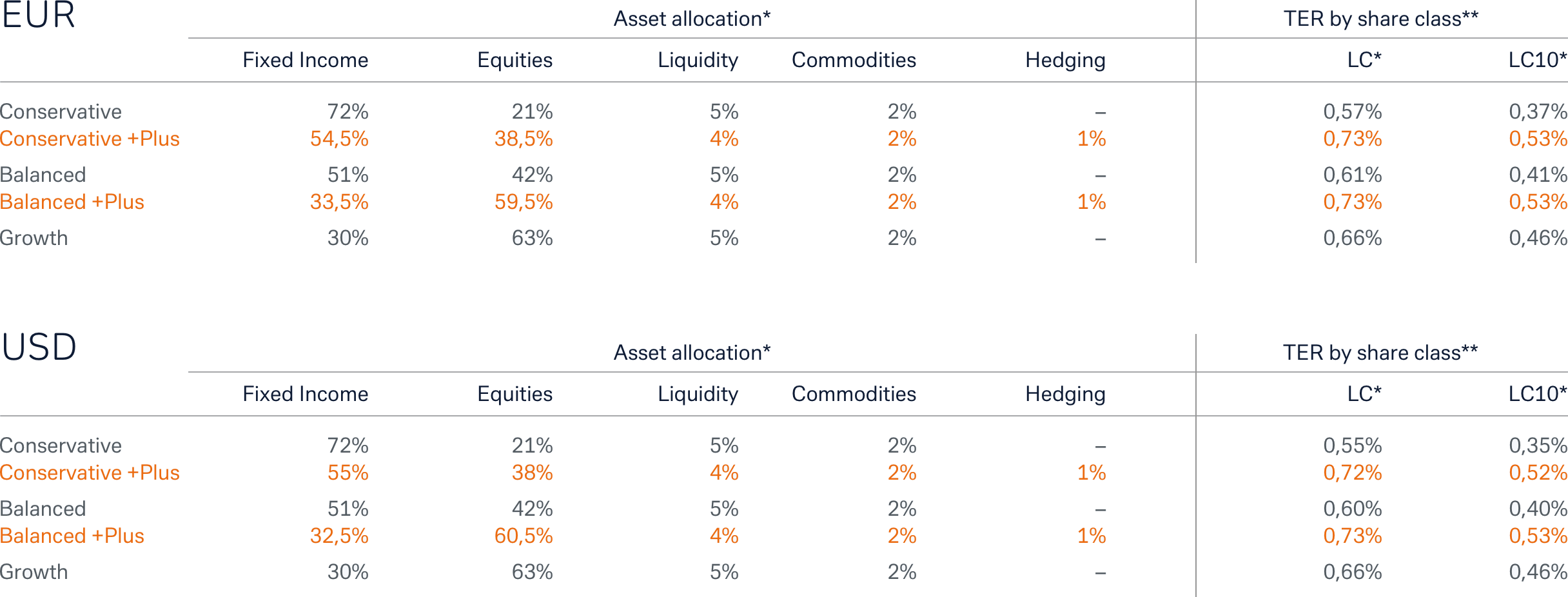

* Expected asset allocations as of Day 1. For illustrative purposes only and subject to change.

** Total Expense Ratio (TER) represents the charges investors can reasonably expect to be taken from the fund over a year, as of day one (excluding any transaction cost on the fund level). This excludes any potential entry fee (max 1%) for investors. Figures shown are charges for the LC and LC10 share classes.

The minimum investment for the LC10 share class is 10 mn EUR or USD. Deutsche Bank Wealth Management receives investment advisor fees and trailer fees for certain share classes, which are already included in the TER. For details, please ask your Relationship Manager.

This investment may have negative performance, and the value of the investment strategy may fall significantly below the initial amount invested. High volatility or high concentration on only a few asset classes might occur on a short-term basis. No assurance can be given that investment objectives will be achieved. All investors should read the prospectus to ensure they are fully aware of the risks.

During periods when equity markets move sideways, the asymmetric investment strategy may underperform, as the option premium will be lost and potentially not be compensated by higher equity exposure. As a result of the higher equity quota, volatility (standard deviation) in the portfolio will increase and the daily fluctuations of the portfolio will be higher (see footnote 6 for further details).

The DB WM Strategic Asset Allocation (SAA) Funds help you focus on the long term and build your core portfolio by harnessing the expertise and robustness of our index-based asset allocation model.

Footnotes

1 DWS is the Management Company and the Fund Manager. Deutsche Bank Wealth Management acts as the Investment Advisor of the Funds.

2 Plus means continuous portfolio hedging so that a targeted lower value limit is met with a high probability (99%). This does not constitute a loss limitation commitment or capital guarantee or a statement by the Bank that it will be able to comply with the targeted loss limitation. In particular, the targeted loss limitation does not rule out the possibility of higher losses arising (no capital protection). The hedging can lead to a reduction in the return.

3 SAA is the long-term allocation of a portfolio’s investments between different asset classes in a way that is intended to be optimum for the fund investor by delivering the best possible level of returns for a given level of risk. A robust approach to SAA means understanding the characteristics of each parameter and how they influence the process of portfolio optimization, such as, being less sensitive to unstable parameters, avoiding unbalanced over-optimization, and reducing the probability of generating bad performance.

4 Exchange traded funds (ETFs) are open-ended, regulated mutual funds that are listed on stock exchanges and aim to track as closely as possible the performance of a given benchmark, usually an underlying index.

5 There are additional costs associated with the Plus strategies, which are already included in the TER (excluding any transaction cost on the fund level).

6 Maximum loss with a 99% probability, however this is not a guarantee. Example: Risk budget = 10% ->In 99 out of 100 cases, the maximal loss is 10% or less. Similarly, in one out of 100 cases, the loss is greater than 10%. For the Plus funds, the risk budgets (using a 99% confidence level) of -10% p.a. and -18% p.a., are provided on a daily rolling basis over a 12-month forward-looking time horizon. This means that for any given date, the target loss limitation on a 12-month forward-looking time horizon is implemented with reference to the current fund value, i.e. risk budget (99%) on January 5th = -10% for the next 12 months; risk budget (99%) on May 28th = -10% for the next 12 months.

Disclaimer

This document is a marketing communication. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and it is not subject to any prohibition on dealing ahead of the dissemination of investment research. Deutsche Bank AG and/or its affiliated companies holds more than 0.5 percent of the capital of the companies which or whose financial instruments are the subject of this document.

No information contained in this document is to be construed as an investment recommendation, investment advice or any other type of recommendation to acquire, hold or sell any financial instruments. This document is only a high-level summary of certain features of the funds mentioned. This document does not substitute any investment advice tailored to the personal circumstances of any investor.

Detailed and comprehensive information on the funds can be found in the Key Investor Information Documents and the prospectus, supplemented by the most recent annual statement and the semi-annual statement if more recent. These documents are the sole basis for any acquisition of shares in the funds. They can be obtained in electronic or printed form free of charge from your relationship manager at Deutsche Bank or DWS Investment GmbH, Mainzer Landstraße 11 -17, D 60329 Frankfurt, Germany.

Past performance is not a reliable indicator of future results. Unless otherwise expressly marked in this document, all statements of opinion are representative only as of the current analysis of Deutsche Bank and subject to change at any time.

The publication of this documents and any information contained therein as well as any marketing or distribution of the financial instruments mentioned therein is only allowed in those jurisdictions where this is not in violation of any applicable laws.

The provision of this document as well as the direct or indirect solicitation, marketing or distribution of the financial instruments mentioned therein in the United States of America, to US citizens, persons resident or otherwise domiciled in the United States of America is prohibited.

Investor should consult their tax advisers in relation to any details of personal tax implications of acquiring, holding or selling or redeeming shares in the funds. Tax treatment depends on the individual circumstances of each investor and may be subject to change. Any information on the funds contained in this document is not to be construed as a reference to the categorisation of the funds under the German Investment Tax Reform Act. More detailed information on taxation can be found in the prospectus of the relevant funds and further additional tax information can be obtained under: https://www.deutsche-bank.de/pfb/content/privatkunden/pk_rechtliche_hinweise.html

Deutsche Wealth Management is the brand name of the Wealth Management unit of Deutsche Bank AG and its subsidiaries. The responsible legal entities offering products or services of Deutsche Bank Wealth Management to customers are named in the relevant contracts, sales documents or other product information.

© 2020 Deutsche Bank AG. All rights reserved. April 2020